You can claim up to $300 for work from home expenses without receipts. For higher claims, keep detailed records.

Working from home has become the new normal for many. Understanding how to claim home office expenses can save you money. The IRS allows deductions for expenses directly related to your home office. This includes costs like utilities, rent, and internet.

You must use part of your home exclusively for work. Keep accurate records to maximize your claims. Knowing the rules helps you avoid mistakes. It’s essential to understand what qualifies as a deductible expense. Proper documentation ensures you can claim the most without hassle. This guide helps you navigate the process smoothly. Save on your taxes by correctly claiming your work from home expenses.

Credit: www.sunlife.ca

Eligibility Criteria For Home Office Deductions

To qualify for home office deductions, you must use part of your home for work. The space must be used regularly and exclusively for business. This means you cannot use it for personal activities. The home office should be your principal place of business. You may claim a deduction if you meet these conditions.

A designated workspace is necessary. It should be a separate room or clearly divided area. The space must be used only for work purposes. You cannot use it for other activities. Ensure it is distinct from living areas. This helps in qualifying for deductions. Keep records to prove this.

Credit: m.youtube.com

Calculating Your Deductions

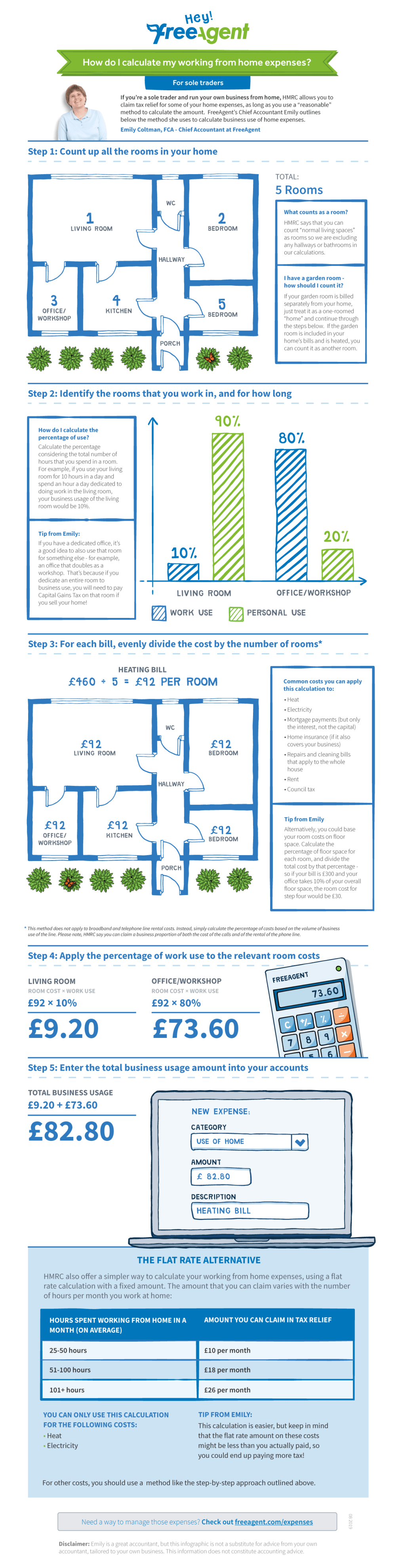

Actual Expense Method lets you claim based on your real costs. Keep all your receipts safe. You can include rent, electricity, and internet costs. A dedicated work area is needed. Measure the space and calculate its percentage of your home. Apply this percentage to your home expenses. This method needs more effort but can give higher claims.

Simplified Option offers a flat rate per hour worked. No need to keep receipts. This option is easier but may give lower claims. You can claim up to 500 hours per year. This method suits those with less paperwork. Choose the method that fits your needs best.

Common Work-from-home Expenses To Claim

Office supplies like paper, pens, and notebooks are claimable. Equipment such as computers, printers, and desks can also be claimed. Furniture like ergonomic chairs are part of this category. Software needed for work is claimable too. Keep receipts for all purchases. Claiming these expenses can save you money.

Home internet costs are a major expense. Electricity used during work hours is claimable. Heating and cooling costs can be included. Phone bills for work calls are also valid. Keep records of all utility bills. Calculate the portion used for work.

Tips For Maximizing Your Deductions

Good records help you claim the right amount. Keep all receipts and bills. Use a notebook or app to track expenses. Note the date and purpose of each item. This helps during tax time. Organized records make it easy to prove your claims. This can save you from audits.

There are limits on what you can claim. Some expenses have caps. This means you can only claim up to a certain amount. Check the rules for your country. Some items might not be claimable. Knowing these limits helps you plan better.

Credit: www.savespendsplurge.com

Frequently Asked Questions

How Much Can You Write Off If You Work From Home?

You can write off a portion of your home expenses, like utilities and rent, based on your workspace size. The IRS provides a simplified option of $5 per square foot, up to 300 square feet. Consult a tax professional for specific deductions.

How Much Of My Home Expenses Can I Write Off?

You can write off home expenses if you use a portion exclusively for business. The IRS allows deductions for mortgage, utilities, and repairs. The deduction is based on the percentage of your home used for business. Always consult with a tax professional for accurate calculations.

What Are The Irs Rules For Home Office Deduction?

The IRS allows home office deductions for dedicated, regular use of part of your home for business. The space must be the principal place of business or where you meet clients. Only expenses directly related to the home office are deductible.

How Much Can You Claim For Home Office On W 2?

You can’t claim home office expenses on a W-2. Only self-employed individuals can claim this deduction.

Conclusion

Understanding your work-from-home expenses is crucial. Keep track of your costs and consult tax guidelines. Claiming accurately ensures maximum benefits. Stay informed about updates to maximize your deductions. Proper documentation and awareness can help you optimize your claims. Remember, every little bit helps in reducing your taxable income.